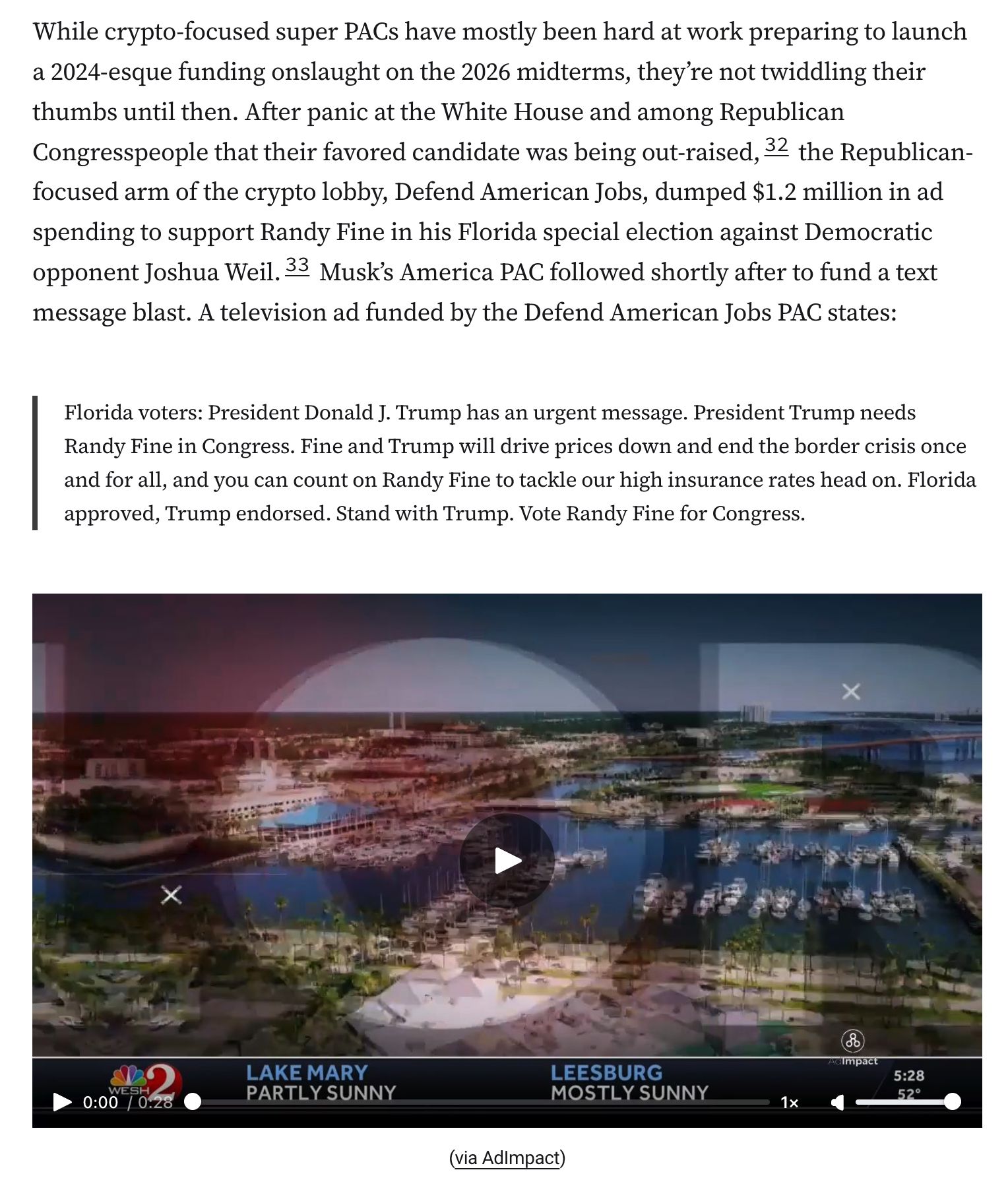

The crypto super PACs have spent a combined $1.5 million on two special elections in deeply red districts in Florida, where Republicans have been panicking about being outspent by Democrats. Musk’s America PAC also dropped some cash to help out Trump’s picks.

tags: #crypto #cryptocurrency #uspol #uspolitics

tags: #crypto #cryptocurrency #uspol #uspolitics

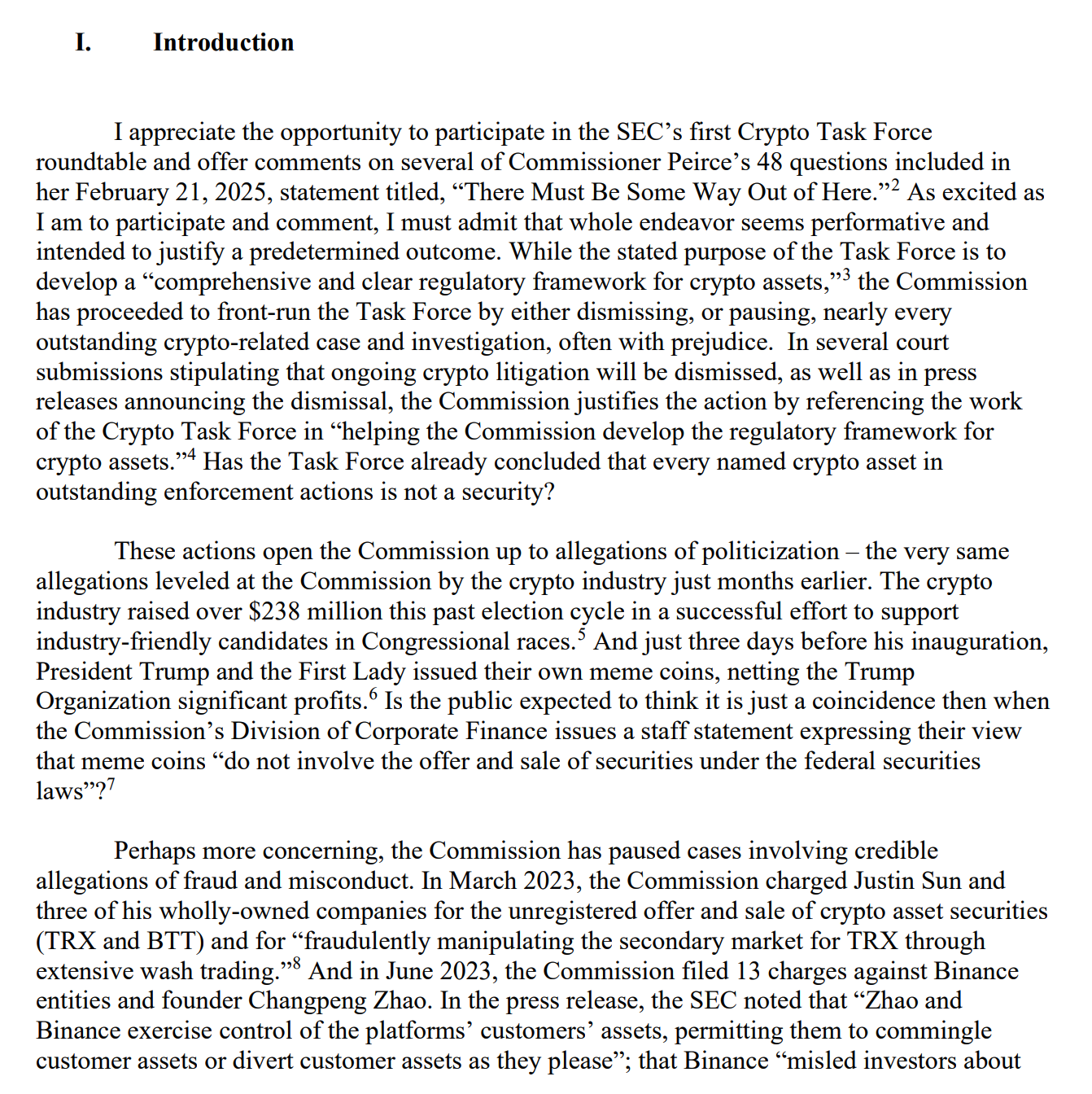

Other input has come from the likes of Lee Reiners, who writes “I must admit that whole endeavor seems performative and intended to justify a predetermined outcome.”

tags: #crypto #cryptocurrency #uspol #uspolitics

The SEC has requested input to write essentially entirely new rules for the crypto industry, and the industry has been only too happy to oblige.

tags: #crypto #cryptocurrency #uspol #uspolitics

And Trump’s WLFI is looking to launch a stablecoin. Though Trump has described central bank-controlled stablecoins as “a dangerous threat to freedom”, he seems to have no qualms with a president-controlled token.

tags: #crypto #cryptocurrency #uspol #uspolitics

Trump Media execs have filed paperwork for a SPAC to target the crypto industry, reasoning that it’s strategic because of Trump’s “unprecedented steps to integrate digital assets into the national financial strategy” that were “aimed at benefiting the digital assets industry”.

tags: #crypto #cryptocurrency #uspol #uspolitics

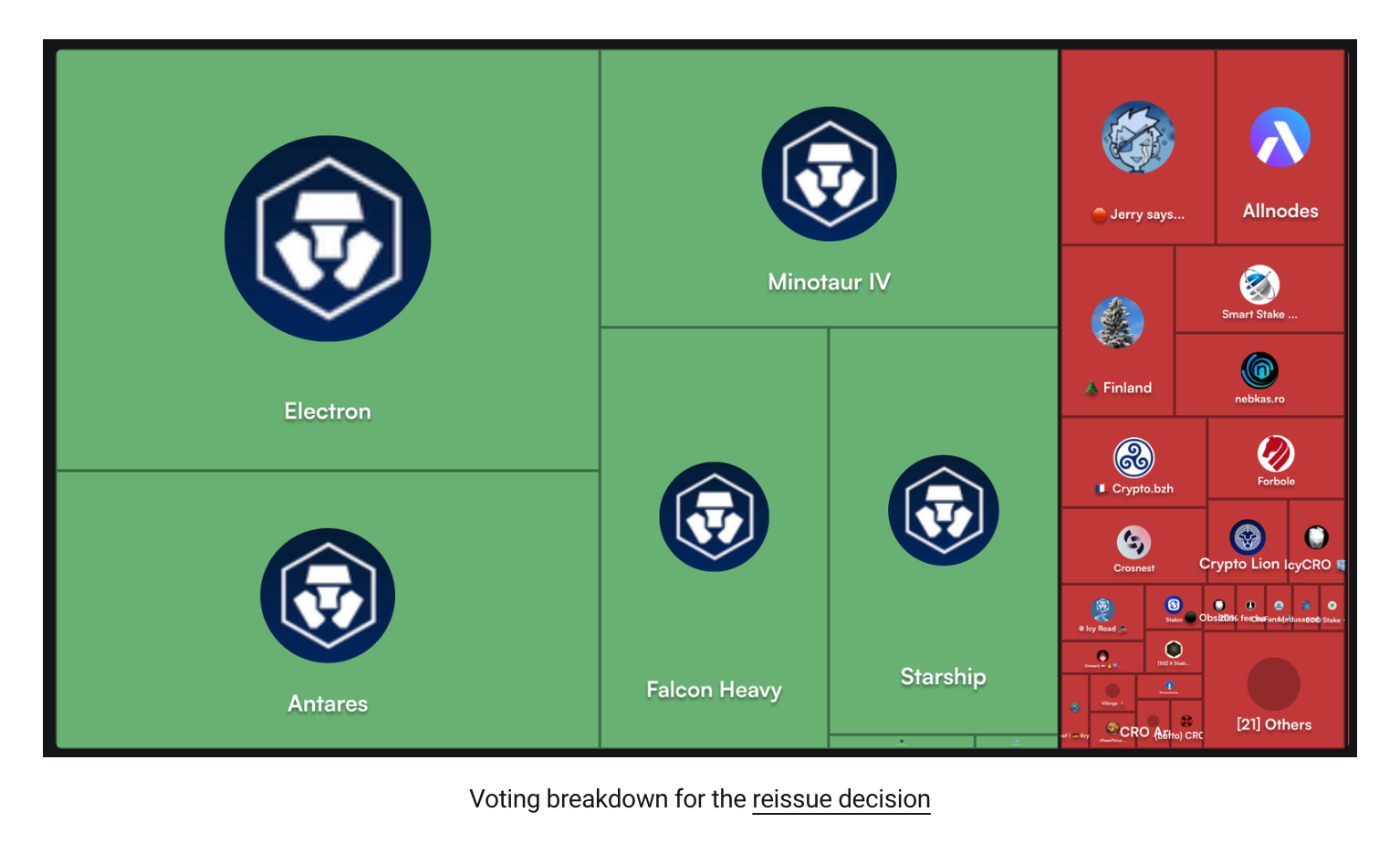

In order to close the deal, Crypto.com had to resurrect $7 billion in CRO tokens that were burned in 2021. This was decided by a “vote” in which Crypto.com validators controlled more than 70% of the voting power — nearly all other CRO holders opposed.

tags: #crypto #cryptocurrency #uspol #uspolitics

Trump is seeking to expand his personal crypto footprint, and his Trump Media company is looking to partner with Crypto.com to launch ETPs. The Singapore-headquartered company is an odd choice of partner for a plan with a “Made in America focus”.

tags: #crypto #cryptocurrency #uspol #uspolitics

Lead crypto adviser Bo Hines is already hard at work getting “a lot of high IQ people” to work on “countless ideas” for how the US can add more bitcoin to its reserve while remaining technically “budget neutral”.

tags: #crypto #cryptocurrency #uspol #uspolitics

Newsletter: As the US government lays a very favorable groundwork for the crypto industry, Trump positions himself for maximum personal profits. Meanwhile crypto companies write their own rules, and an adviser mulls swapping US gold reserves for bitcoin.

It's not clear that BitBoy even knows he's been sued yet; he was arrested two days ago after sending threatening emails to the judge in a DIFFERENT defamation case he's facing from his former business partners after he publicly accused them of various crimes

Amusingly, BitBoy once tried to file a defamation lawsuit of his own against a YouTuber who called him a "shady dirtbag"

He dropped the suit almost immediately after the YouTuber raised over $200,000 for his defense in a matter of days, and Armstrong admitted he didn't know lawsuits were public

BitBoy also suggested that O'Leary was trying to have him killed, and claimed he'd swatted him. Shortly after, he posted O'Leary's cell phone number and encouraged his followers to "call a real life murderer"

Quote from man sued: "What are you gonna do, sue me?"

Kevin O'Leary has sued crypto personality Ben Armstrong (aka "BitBoy Crypto") for repeatedly claiming O'Leary murdered two people

(O'Leary and his wife were indeed involved in a boating collision that killed two people in 2019; O'Leary states in the lawsuit that it was his wife driving the boat, and she was acquitted of any charges)

Complaint: https://www.courtlistener.com/docket/69798755/1/oleary-v-armstrong/

tags: #blockchain #crypto #cryptocurrency #cryptography #decentralization #dweb #ethereum #technology #web0 #web2 #web3

to: https://social.coop/users/dweb https://social.coop/users/mai

So far, I have been delving into the #Web3 and #crypto debate only superficially, as the very few notions I got led me to abhor any kind of technology related to the #blockchain.

Since I started my new job at @dweb, though, I am finding myself revisiting my position by deepening my knowledge on the topic. I am mostly drawing the same conclusions—crypto is terrible—yet I am glad I am learning more also on what I am very critical about.

I am particularly thankful to @mai for writing this article, which I believe is a great starting point to develop an informed opinion.

Above all, as mai points out, nothing is all-bad, and there are for sure ideas and practices that can be learned (as cautionary tales in the worst case scenarios) even from problematic technologies, communities, and/or founders.

tags: #coinbase #crypto #cryptocurrency #uspol #uspolitics

(Don’t forget that $50 million of those contributions appeared to be blatantly illegal, although Trump is already hard at work making the Federal Elections Commission even less effective than it previously was.)

https://www.citationneeded.news/coinbase-campaign-finance-violation/

tags: #coinbase #crypto #cryptocurrency #uspol #uspolitics

Coinbase says that the SEC has agreed to drop the enforcement case against the company. It only cost them $75 million in political contributions.

tags: #crypto #cryptocurrency #uspol #uspolitics

Sadly, the Congressional majority appears far more eager to spend its political capital making bold statements about debanking only when it applies to crypto billionaires, while dismantling the very agencies best positioned to help debanking victims.

tags: #crypto #cryptocurrency #uspol #uspolitics

Meanwhile, the agency most involved in handling debanking is being dismantled, to cheers from the crypto industry. “Debanking” is a crypto rallying cry only so far as it supports their deregulatory agenda, dropped the second it might result in actual consumer protections.

tags: #crypto #cryptocurrency #uspol #uspolitics

Broadly: despite bipartisan agreement that discriminatory debanking happens to some groups and individuals, there is no agreement about who those people are, or what to do about it.

tags: #crypto #cryptocurrency #uspol #uspolitics

But the industry’s bold claims that “Operation Choke Point 2.0 is real” are hyperbole intended to mislead. Perhaps they need more time to acquire the proof they claim exists. Perhaps they will just continue to claim it exists, and hope no one notices they haven’t produced it.

tags: #crypto #cryptocurrency #uspol #uspolitics

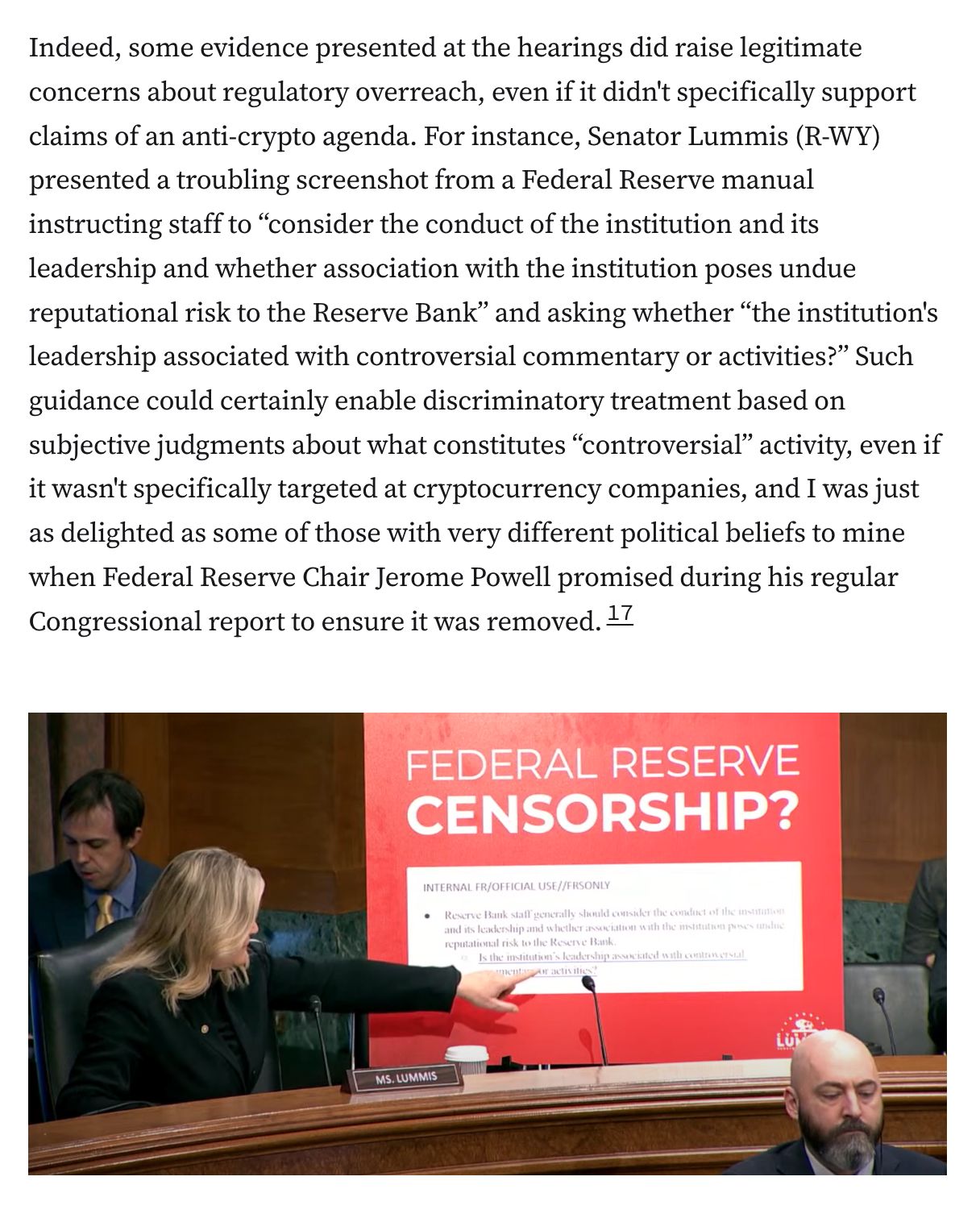

We are in a situation where reasonable people can look at the same set of documents and some will conclude that the regulators are simply doing their jobs, while others conclude that regulators are improperly pressuring banks to not provide services to those customers at all.

tags: #crypto #cryptocurrency #uspol #uspolitics

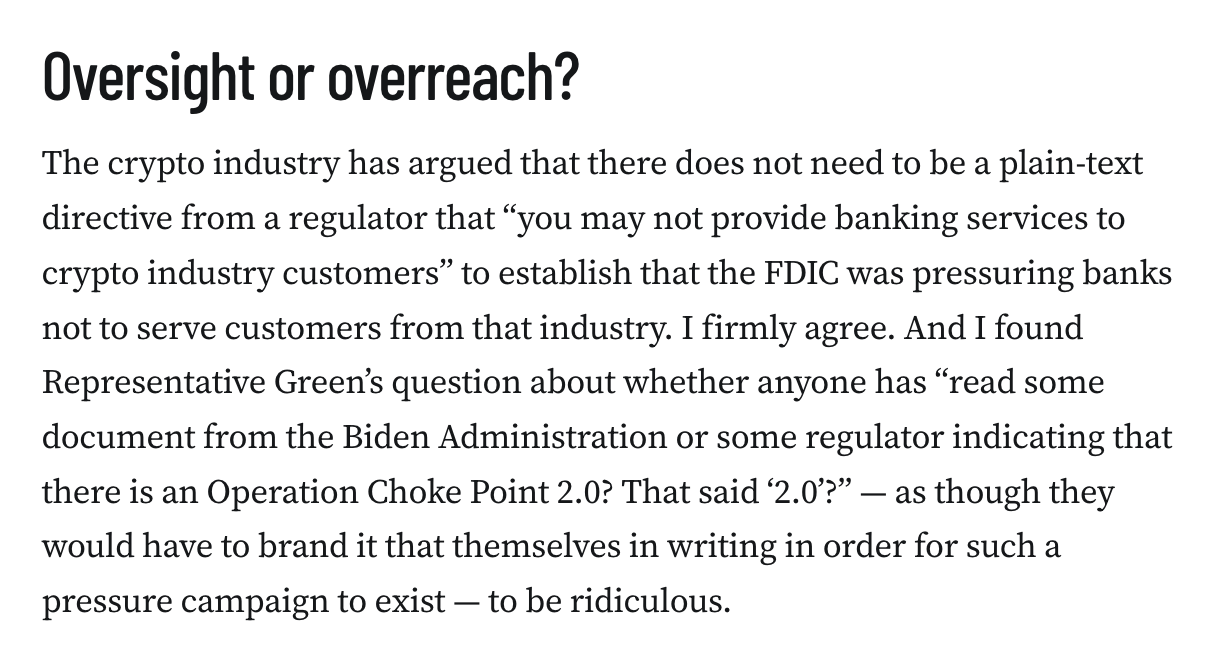

So: is this regulatory oversight, or overreach?

tags: #crypto #cryptocurrency #uspol #uspolitics

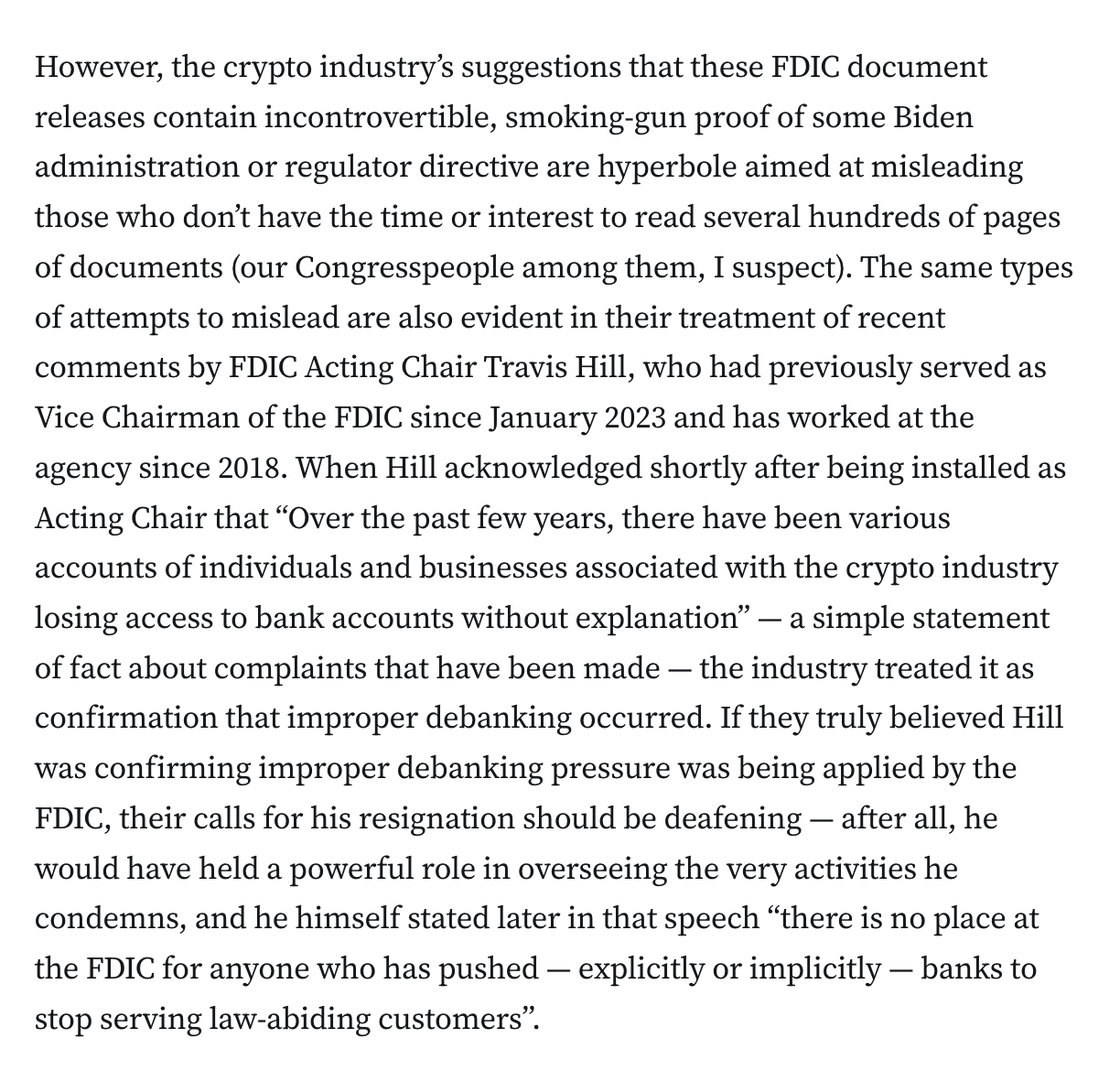

There were some conversations with banks about offering depository accounts to crypto companies, which I focused on in particular as this is the root of the industry’s claims.

tags: #crypto #cryptocurrency #uspol #uspolitics

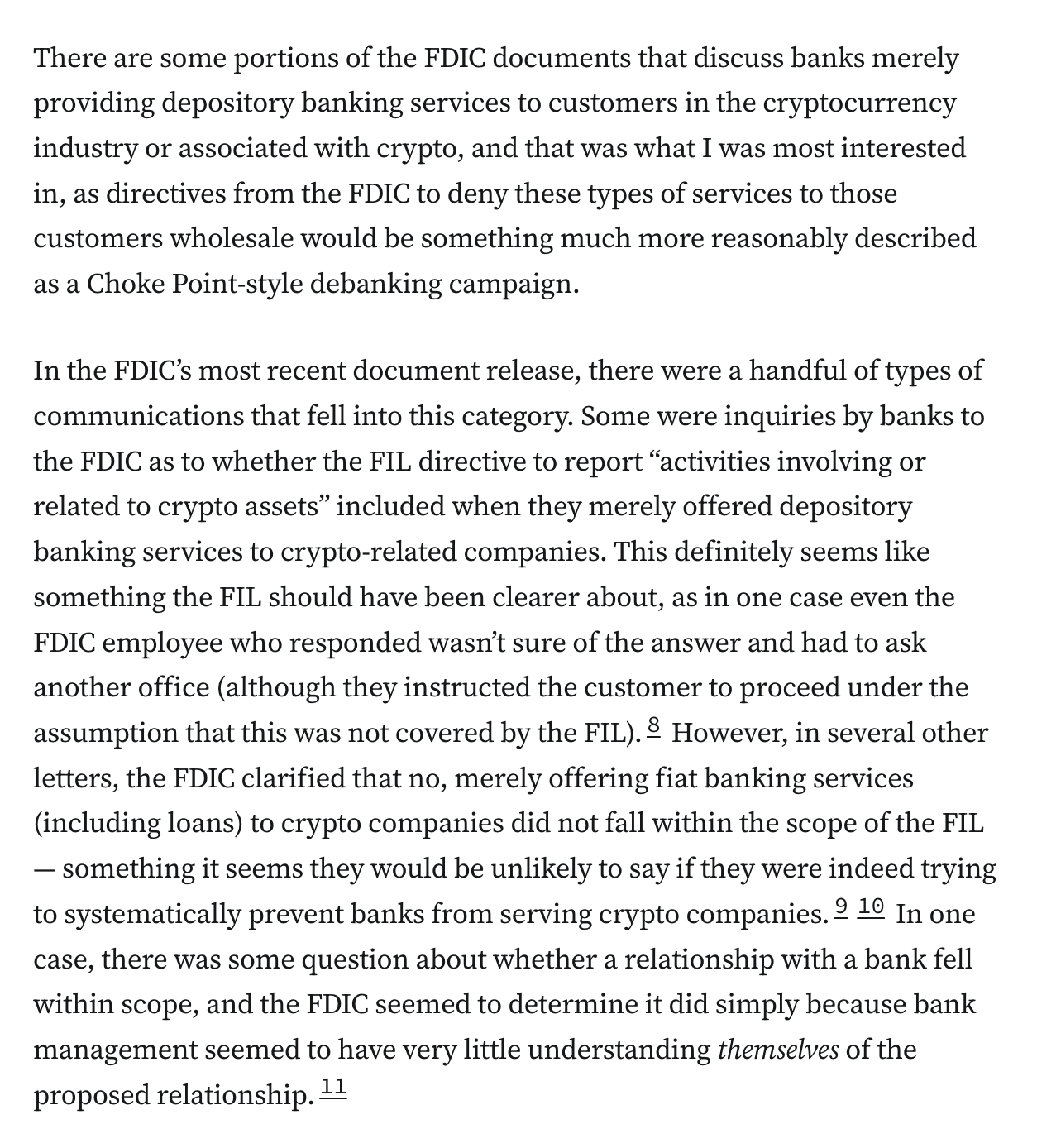

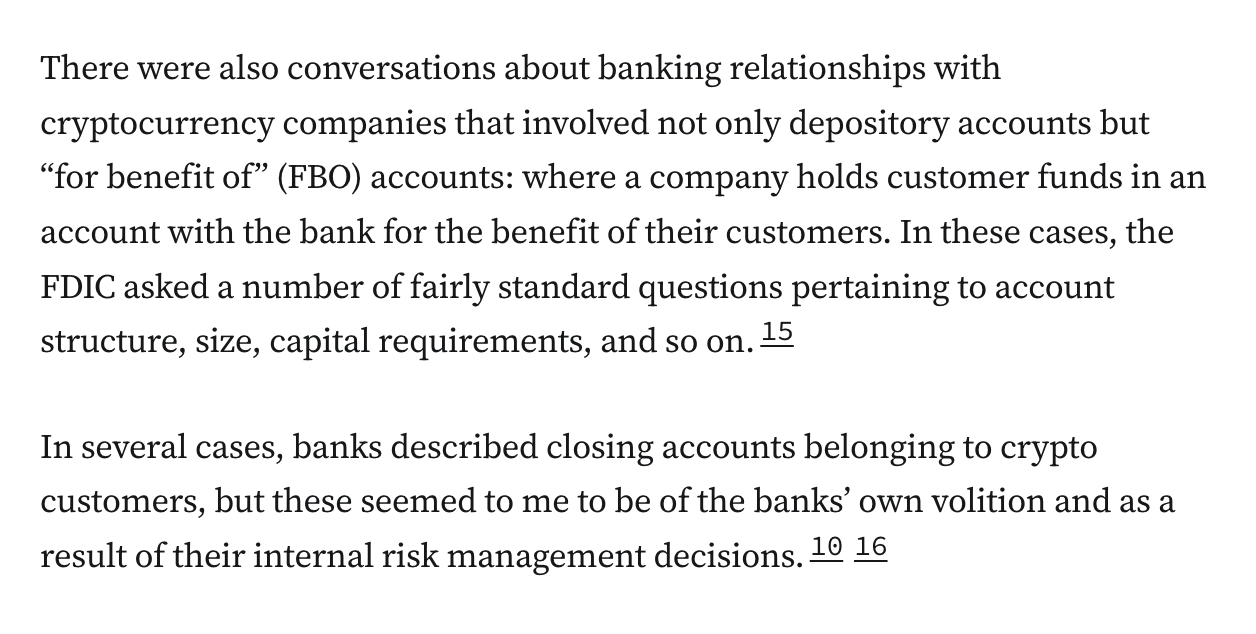

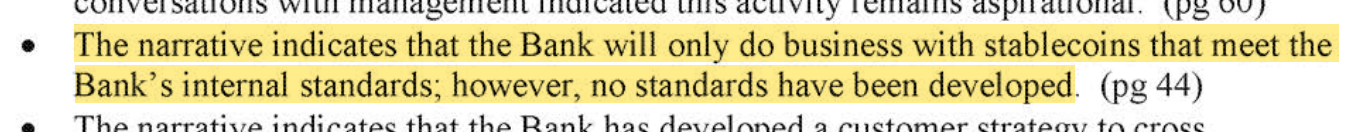

However, there is no shortage of extremely concerning replies from banks to these questions about the banks’ own planned crypto offerings and partnerships with crypto companies, suggesting the FDIC was more than justified in making these inquiries. Just a few highlights:

![Though the details were scarce, the press release suggested the crypto ETFs would “include a unique ETF basket of cryptocurrencies incorporating Bitcoin, Cronos, and other crypto assets.” (Cronos is the token issued by Crypto.com subsidiary Cronos Labs.) All of this will happen via the “Truth.Fi” brand, a business venture announced by Trump Media in February [I76]. There has been some controversy over this deal in the crypto world, centering around a decision by Crypto.com and Cronos to fund the deal by “reissuing” tokens notionally worth $7 billion that had been burned (ostensibly permanently destroyed) in 2021.7 The proposal was unpopular among many Cronos holders, and comments on the proposal were universally negative. “Veto. Reversing a burn is a violation of trust and integrity of the ecosystem,” commented one community member. “This is a disaster on so many levels—I don’t even know where to begin. This should be a firm NO, with a veto. It feels more like a rug pull from [Crypto.com], where they’re essentially seeking exposure to the US reserve using consumers' money,” argued another.8 Most Cronos validators voted no on the proposal. However, at the last minute, a sudden surge in yes votes came in from validators operated by Crypto.com, which controls 70–80% of the voting power in Cronos, forcing through the proposal.9](https://files.honk3.org/file/G9T3L3MVBbw8pH3863GTN.png)

![Any sense of relief that may have followed the March executive order’s stipulation that a “strategic bitcoin reserve” would not incur costs to taxpayers has melted away with news that White House are already looking for creative ways to acquire bitcoin in a “budget neutral” way.

Bo Hines, the baffling choice of executive director for the White House’s “crypto advisory council” [I72, 74], sat for an interview in which he commented that “there’s a lot of high IQ people working on ... countless ideas” to ~~pump bitcoin prices to profit bitcoin holders~~ acquire additional bitcoins for the reserve, including “realizing the gains” on US gold reserves. Asked by the interviewer if he might consider selling some of the country’s gold reserves to swap them for bitcoin, Hines answered, “if it's budget neutral and doesn't cost a taxpayer a dime”.5

In the same interview, he commented that bitcoin “is different” from the other crypto assets like Ether, Ripple’s XRP, Solana, or Cardano’s ADA. “It’s unique. It’s a commodity, not a security.” Evidently, Hines has not been briefed that they’re not supposed to admit anymore that these other crypto assets are securities.5](https://files.honk3.org/file/G9T2V4cg6g733wDBCls7J.png)

![“expose him [Armstrong] as the dirtbag he is,” and states several times that Armstrong is one of a group of “dirtbag influencers.” 16. Atozy’s Video continues Atozy’s “dirtbag” attack with this statement: “so in case you didn’t know what an absolute sleezy dirtbag of a YouTuber is, here’s BitBoy Crypto, a prime example of that.” On another occasion, Atozy’s Video states that “this man [Armstrong] has enriched himself by being an all-around dirtbag.” 17. Atozy’s Video directly attacks Armstrong’s livelihood stating that when it comes to cryptocurrency advice, Armstrong is “not someone you should be looking up to for any advice whatsoever.” To drive the point home, Atozy’s Video asks “how is this man a reputable source for crypto investment advice?” The Atozy Video answers its own rhetorical question stating that Armstrong “cannot be trusted with financial advice because you don’t know whether he’s trying to enrich you or himself.”](https://files.honk3.org/file/G9Tr24DSwDFrctDP73g43.png)

![27. On March 19, 2025, Armstrong unleashed another tweet accusing O’Leary of committing “actual crimes”: “Doesn’t everybody think it’s weird that I’ve been publicly calling … @kevinolearytv [a] murderer[] and yet not a single word or legal action? It’s almost like they ‘can’t’ because a lawsuit would open up their actual crimes and they know it.”](https://files.honk3.org/file/G9TTnnSXMYQ4z476gpPXw.png)

![The crypto industry’s co-opting of legitimate debanking concerns represents a particularly cynical form of regulatory theater. Companies like Coinbase claim to be champions fighting discriminatory banking practices while simultaneously celebrating the shutdown of the CFPB — the very agency most equipped to tackle systemic debanking. When Coinbase CEO Brian Armstrong took to Twitter to celebrate Musk’s attempt to shutdown the CFPB as “100% the right call”, describing the Bureau as “unconstitutional” (it isn’t24) and “an activist organization that has done enormous harm to this country”, he revealed the industry’s true priorities.25 Debanking is suddenly less of concern when the same group that is most equipped to tackle it has proposed consumer protections for crypto customers [I73] that could cause Coinbase to have to reimburse some of the $300 million or so stolen from its customers over the past year alone [I74]. “Debanking” is a crypto rallying cry only to the extent that it supports their deregulatory agenda, to be dropped the second that addressing debanking might result in consumer protection requirements forcing companies like his to treat customers properly.](https://files.honk3.org/file/G8v62TKV44CTgKJS25HKZ.png)

![And some even seem to disagree with themselves, taking inconsistent stances based on the victim of the debanking. For example, in September 2023, Senator Ricketts (R-NE) led opposition to the SAFER Banking Act, highlighting money laundering risk and suggesting that limiting banking access to marijuana businesses would help him further his opposition to the marijuana industry (he alleged marijuana causes “significant mental health damage to youth” and “is associated with psychosis, motor vehicle accidents, respiratory problems, and low birth weight”).20 Now, however, he brushes aside money laundering concerns when crypto is involved, and argues that “It undermines the rule of law in our country if regulators start pushing an agenda of what they want to see, what kind of businesses you do business with versus what you’re allowed to do. ... A legal business should not lose access to the banking system just because they deal in firearms or crypto or something like that because a regulator doesn’t like that. That’s just simply wrong. But that’s what we’ve seen of course out of the last two administrations: it was mentioned earlier about Operation Choke Point 1.0 under the Obama administration and firearms dealers for example that were disfavored, were prejudiced against and [regulators] tried to force out of the financial system.”21](https://files.honk3.org/file/G8vHq191n7mH3F43gDvb2.png)

![This pattern of selective interpretation and opportunistic outrage is not limited to their treatment of Hill's comments, however. Their attacks on those who have not claimed that crypto companies have been denied bank accounts, and who have not claimed that it’s impossible that there was government pressure to debank crypto companies, but who have simply pointed out that the supposedly firm evidence of a governmental anti-crypto debanking campaign is anything but, demonstrate that their goal is not to uncover the truth about debanking, but to advance their dubious narratives in service of their policy agendas [I74].

It’s also worth noting that the crypto industry's claims of a government-led debanking campaign are essentially unfalsifiable, given the lack of public access to private government documents and correspondence. Yet, despite now having a Republican-controlled House, Senate, and Presidency, with pro-crypto appointees installed throughout regulatory agencies and Elon Musk and his team of interns rooting around in every government database they can get their hands on, and a new FDIC chair apparently willing to order the release of considerably more documents than his predecessor, the industry has still failed to produce any strong evidence to support its claims. This lack of proof, even with the deck stacked in their favor, is telling. Perhaps they will say they just need more time, but if the evidence of a coordinated debanking campaign were as clear-cut as the](https://files.honk3.org/file/G8v39qJF1FXtgdzHp7qc1.png)

![Some other documents contained discussions between banks and the FDIC about banks’ crypto-related depository customers, but seemed fairly run-of-the-mill. In one FDIC memo, representatives from the bank and the regulator discussed crypto customers with high cash activity, and the need to apply more diligence to understand those cash transactions since they were high risk. The FDIC representative in that case was explicit that “we are not asking the bank to exit these relationships”, and a bank representative expressed that they believed “most of the recommendations [pertaining to digital asset customers] were really good”.12 A very similar conversation occurred between the FDIC and a bank that was providing banking services to a Bitcoin ATM operator, where a bank representative expressed concern that the FDIC “has made a determination that banking these [redacted] customers is not ok”, and an FDIC representative “reiterated that we are not requiring the bank to exit the business, but to conduct more due diligence, look at the potential red flags, and provide the bank’s board with the results. The decision whether or not to continue to bank these customers should be a business decision made by the board after review of the additional information.”13 In a few cases there were broad questions from the FDIC to banks they already knew had crypto-related depository and loan customers, for example a few days after the FTX collapse, when an FDIC case manager asked about “any trends](https://files.honk3.org/file/G8vQJR2pY8h4QT3115h9Y.png)

![The form's responses to principal ownership, length of time in business, and regulatory oversight of the company do not accurately reflect the entity that the bank is contracting with, the entity's organizational structure, or affiliate services. [begin highlight] The form states that [redacted] has been operating since [redacted]; however, [redacted], the entity that the bank contracts with did not exist in [redacted]. [end highlight] The form also states that the regulators](https://files.honk3.org/file/G8vfh5dRz9Cdn5qk4t464.png)

![these customer expectations were generated from [redacted] and included little to no support. [begin highlight] Furthermore, those projections were likely generated when bitcoin prices were rapidly appreciating in comparison to the US Dollar and did not consider any type of range or pullback in the market. [end highlight] Management should revisit the report and consider a range of results that incorporate different levels of adoption and transaction volume.](https://files.honk3.org/file/G8vZ5h191hkw2t4r1gkWQ.png)

![The risk assessment is not commensurate with the potential risk exposure posed. Management approved a Bitcoin Program risk assessment prepared by [redacted] with minimal edits, which lacked independence, lacked a discussion of controls in key areas, or outlined controls/mitigants that did not exist or were inaccurate.](https://files.honk3.org/file/G8vMP1YZ2Dm4kR13YKXkR.png)